In a market defined by volatility, information asymmetry, and capital flows that shift in milliseconds, the Portfolio Manager has emerged as one of the most critical decision-makers in the financial world.

Far beyond stock-picking, portfolio managers develop and execute complex investment strategies tailored to client objectives, risk tolerances, and market cycles. Whether managing multi-billion-dollar pension assets or personal high-net-worth portfolios, they serve as the strategic anchor between market dynamics and long-term value creation.

| According to the U.S. Bureau of Labor Statistics, employment for financial managers, including portfolio managers, is projected to grow 17% from 2023 to 2033, much faster than the average for all occupations. |

This reflects a growing demand for professionals who can navigate market risk, optimize returns, and align portfolios with evolving client priorities, including ESG, alternative assets, and inflation-hedging strategies.

Portfolio management is about judgment under uncertainty. It requires sharp analytical capabilities, a deep understanding of financial instruments, and the ability to make high-stakes decisions that affect individual wealth and institutional capital.

In this blog, we break down the real-world responsibilities, evolving role, skill sets, and compensation landscape of today’s portfolio manager, helping you evaluate whether this career path fits your aspirations or organizational needs.

Table of Contents:

- Who Is a Portfolio Manager?

- Portfolio Manager Roles

- Portfolio Manager Responsibilities

- Essential Skills for Portfolio Managers

- Portfolio Manager Salary Insights

- Career in Portfolio Management

- Conclusion

Who Is a Portfolio Manager?

A Portfolio Manager is not defined by what they do day-to-day, but by the decisions they’re trusted to make.

| “A portfolio manager is a body corporate, which, under a contract with a client, advises or directs or undertakes on behalf of the client the management or administration of a portfolio of securities or funds of the client.” |

They are the strategic brains behind investment portfolios, shaping how capital is allocated, what risks are worth taking, and how long-term value is pursued.

Unlike traders who focus on market timing or advisors who guide client decisions, portfolio managers are accountable for the full performance narrative of the portfolio. They take ownership of investment outcomes across time horizons and shifting market cycles.

What Sets This Role Apart?

Portfolio management is a judgment role. It demands clarity of vision, conviction in uncertainty, and the ability to interpret markets not just for what they are, but for what they might become. In many firms, portfolio managers operate with autonomy, influencing billions in assets and guiding research teams, risk officers, and strategy heads.

The role is distinct from other positions in the financial ecosystem:

- Financial Analysts may evaluate assets; portfolio managers decide how those insights affect the portfolio.

- Traders execute decisions; portfolio managers architect those decisions.

- Financial Advisors focus on client relationships; portfolio managers focus on investment outcomes.

Understanding these differences is critical, especially for those planning a career in this field or hiring for it.

A Career That Has Evolved with the Markets

Today’s portfolio managers don’t just interpret P&L sheets or pick funds. They’re navigating an environment reshaped by:

- Market volatility and tighter capital flows

- ESG mandates and responsible investing

- Advanced risk modeling and AI-based forecasting

- Institutional demand for governance, transparency, and performance consistency

This evolution has made the portfolio manager’s role both more complex and more central to the finance function, especially in institutional settings where the stakes span pensions, endowments, and sovereign assets.

Why the Role Commands Influence

Perhaps what makes the role most compelling, for both candidates and organizations, is its blend of autonomy, accountability, and impact. Portfolio managers don’t just manage money. They shape strategy, influence financial direction, and operate at the heart of value creation.

For ambitious professionals, it’s a career built on intellectual rigor, economic fluency, and a long-term performance mindset.

For organizations, hiring the right portfolio manager is not a staffing decision; it’s a capital allocation strategy.

Portfolio Manager Roles

The title Portfolio Manager may appear singular, but the role is multifaceted. In practice, a portfolio manager navigates between strategy, markets, governance, client partnership, and leadership, each requiring a distinct mindset. Below, we explore these key roles in which the portfolio manager creates value.

1. The Strategist: Translating Strategy into Portfolio Reality

A portfolio manager’s strategic role is not about predicting markets; it’s about ensuring that every investment serves the client or institution’s broader strategic ambition. They operate not as stock pickers but as systems thinkers, translating vision into value and business intent into investment logic.

This role becomes especially critical in large enterprises, where capital is often fragmented across siloed portfolios. Without a unifying strategic lens, investments risk being redundant, misaligned, or worse, completely disconnected from enterprise priorities.

| According to Gartner, “Organizations highly effective at strategic portfolio management are 2x more likely to achieve better business outcomes” than those that aren’t. |

Strategic Alignment in Practice: A Capability-Based Case

A compelling illustration of this role in action comes from a Fortune 500 case study featured in The Execution Challenge (Cameron & Kuehn, 2024). The organization was managing multiple portfolios, each led independently and aligned to different product or functional lines. Despite robust leadership oversight, decision-makers lacked visibility into whether these investments truly reflected enterprise strategy.

To resolve this, the strategic planning and business architecture teams collaborated to analyze investment requests through a capability-based lens. They mapped each project to both:

- Strategic business objectives

- The organizational capabilities it aimed to enhance

What followed was a revelation.

The resulting heatmaps exposed stark misalignments. Projects receiving top-tier funding were, in some cases, not tied to any mission-critical strategic outcome. Conversely, high-priority capabilities lacked adequate investment. There were also redundant initiatives, multiple business units building similar solutions in isolation.

This analysis, enabled by a strategic portfolio perspective, didn’t just shift short-term funding, it reshaped how the organization approached capital planning going forward:

- Every investment now requires a clearly articulated capability enhancement

- Standardized business outcomes were tied to each initiative

- Portfolio leaders gained a new decision-making framework grounded in enterprise coherence

“Strategy execution falters not because of poor ideas, but because resources get scattered,”

In practice, this is the strategist’s job: not just to allocate money, but to orchestrate meaning. It is about ensuring that every asset in the portfolio plays a role in advancing the strategic narrative, whether that narrative is digital transformation, risk-adjusted growth, or long-term resilience.

2. The Risk Translator: Managing the Unknown Without Paralysis

Risk management at the portfolio level is not about avoiding surprises; it’s about anticipating how one failure could trigger many. In this role, portfolio managers move beyond basic risk scoring and instead analyze interdependencies between initiatives, outcome links, shared resources, and schedule overlaps that can silently magnify exposure.

| “Portfolios don’t fail due to individual project risk alone, but due to misunderstood dependencies between components that multiply exposure silently.” |

Case in Point: Risk Interdependencies in a Software Portfolio

In a real-world software development portfolio, a tooling initiative was launched to improve speed, consistency, and developer efficiency across upcoming digital products. On the surface, the project appeared low-risk; it was on time, scoped tightly, and well-resourced.

But deeper analysis revealed something critical: multiple high-value application projects were dependent on the timely and successful delivery of this tool. If it failed or slipped, the entire product roadmap, spanning customer-facing applications, integration modules, and release schedules, would be at risk.

Further, a separate data integration tool was discovered to be a quiet enabler of a cross-product suite. Without this piece in place, the broader system would lack the interoperability promised to clients.

These interdependencies, previously undocumented, highlighted how risks multiply when portfolios are managed without a systems lens. What looked like isolated project challenges were actually structural vulnerabilities with far-reaching impacts on timing, budgets, and business outcomes.

3. The Market Interpreter: Seeing Beyond the Noise

While markets move by the minute, portfolios must hold their ground over months and years. This tension creates one of the most critical responsibilities for portfolio managers: to interpret the market without reacting to every headline. They must distinguish between a fleeting trend and a structural shift, and reposition portfolios accordingly.

| “It’s not about having the most data, it’s about knowing which signal to act on.” |

This interpretive role has only grown more complex. From 2022 to 2024, for instance, global markets witnessed rapid interest rate hikes, a surge in inflation, pressure to de-globalize, and sectoral rotations away from growth tech into energy, healthcare, and defensive assets. For many investors, these changes were disorienting.

But strong portfolio managers didn’t just track these signals; they anticipated their ripple effects.

Mini Scenario: Translating Macro Signals into Portfolio Moves

Consider the rapid rise in U.S. interest rates. A sharp interpreter would recognize how this would ripple across:

- Bond yields: Making long-duration bonds less attractive.

- Growth equities: Which suffer under higher discount rates.

- Emerging markets: Vulnerable to capital outflows and dollar strength.

Rather than chase performance, the portfolio manager reallocates toward value-oriented equities, short-duration fixed income, or inflation-protected securities, aligning portfolio structure with market momentum without abandoning the core investment thesis.

This is what makes the market interpreter so vital: they read the macro landscape not just to understand what’s happening, but to determine what’s investable.

Why This Role Matters More Today

In volatile or fast-shifting economies, waiting for clarity can be more dangerous than acting with discipline. Clients and institutions alike look to their portfolio managers not just for execution, but for narrative clarity:

- Are we positioned for a soft landing or stagflation?

- Is AI another bubble or a fundamental rotation?

- Should we hedge, hold, or double down?

The best interpreters don’t make binary predictions. They create strategic flexibility within the portfolio, building optionality while managing conviction.

4. The Client Proxy: Navigating with Empathy and Discipline

Portfolio managers are often seen as analysts, strategists, or market experts. But for many clients, especially in high-net-worth and institutional environments, they’re also something more personal: a financial proxy who makes judgment calls on their behalf when the stakes are high and the data is uncertain.

In this role, the portfolio manager doesn’t just build strategies; they embody the client’s risk preferences, ambitions, and anxieties, turning abstract investment plans into meaningful action. The job requires empathy, but it also demands restraint, because client’s instincts can sometimes run counter to long-term interests.

“The biggest risk to investment performance isn’t the market, it’s investor behavior.”

|

Managing Emotion in Rational Structures

During volatile markets or major life events, clients may want to sell at the bottom, double down at the peak, or overhaul a plan out of fear. A disciplined portfolio manager listens without judgment but steers with clarity.

They realign the conversation back to core principles:

- What goals are we serving?

- What time horizon are we managing to?

- What does risk tolerance really mean right now?

And when needed, they push back, with data, historical perspective, and conviction, because staying invested through cycles is often more powerful than making reactive moves.

Mini Scenario: When Steady Hands Outperform Bold Moves

In the aftermath of the March 2020 market crash, a segment of investors panicked, selling off portfolios at a loss, fearful of a prolonged recession. Portfolio managers who understood their clients deeply knew when to pause, when to communicate, and when to hold the line.

Those who kept clients invested or strategically rebalanced into undervalued sectors saw significant gains in the following recovery, while those who exited missed critical upside.

This wasn’t luck. It was a proxy relationship grounded in trust, communication, and courage under pressure.

Why This Role Is Central to Long-Term Success

- Translate complex portfolio decisions into a language clients understand

- Adjust strategies as client needs evolve (retirement, liquidity events, funding obligations)

- Provide psychological safety, not false certainty, during turbulent periods

| According to research, behavioral coaching contributes up to 150 basis points (1.5%) annually in added value, simply by helping clients stay on track with their investment plan. |

Being a client proxy isn’t about always agreeing. It’s about earning the trust to challenge, reframe, and reinforce decisions that will matter ten years from now, long after today’s headlines are forgotten.

5. The Investment Team Navigator: Leading Experts, Aligning Execution

A portfolio manager doesn’t operate in isolation. Behind every well-performing portfolio is a tightly coordinated ecosystem of analysts, risk officers, traders, operations leads, and governance professionals. In this context, the portfolio manager becomes a navigator of teams, orchestrating diverse inputs into a unified investment direction.

This role demands not just leadership, but synthesis. Multiple functions must stay aligned: strategy with liquidity, long-term asset allocation with short-term rebalancing, and client constraints with market realities.

Case in Point: Aligning Teams in an Institutional Portfolio

In a CFA Institute case study of a large university endowment, the investment office faced a common challenge: the strategic asset allocation included significant exposure to illiquid assets, such as private equity and real estate, while still needing to meet ongoing cash outflows to fund university operations.

Portfolio managers had to work across internal teams, asset allocation specialists, liquidity managers, and derivatives experts to manage rebalancing efficiently. Together, they introduced:

- A liquidity management framework (e.g., time-to-cash tables).

- Derivatives overlays to adjust exposure without disrupting long-horizon investments.

- Tactical rebalancing mechanisms using futures and swaps to manage drift.

The result was a coordinated investment operation that could adapt to market volatility, meet spending needs, and still honor the endowment’s strategic long-term objectives.

6. The Ethical Anchor: Safeguarding Trust, Transparency, and Compliance

Amid performance metrics, market strategies, and asset class debates, one role remains non-negotiable for a portfolio manager: ensuring ethical integrity and governance oversight. This is not just a compliance checkbox; it’s the foundation on which trust, credibility, and long-term client relationships are built.

In this role, the portfolio manager acts as the ethical anchor, ensuring every investment decision adheres to fiduciary responsibilities, transparency standards, and regulatory obligations. In institutional settings, this includes acting as a gatekeeper across ESG mandates, internal controls, and conflict-of-interest protocols.

How Governance Shows Up in Real Portfolio Practice

- Fiduciary Duty: Whether managing a pension fund, university endowment, or individual retirement portfolio, the portfolio manager is bound to act in the client’s best interest, even when that means deviating from market consensus or firm-wide positioning.

- Regulatory Alignment: Portfolio managers operate within strict frameworks, including SEC rules, MiFID II, or the CFA Code of Ethics. Missteps in disclosure, risk classification, or client communication can result in reputational damage or legal exposure.

- ESG Accountability: Increasingly, governance includes ensuring that actual screening, reporting, and proxy voting practices back ESG claims. Greenwashing risk is not theoretical; it’s real, and regulators are watching.

- Manager Oversight: For portfolios with external mandates, portfolio managers must conduct due diligence not only on asset performance but also on the integrity and conduct of sub-managers, monitoring for style drift, transparency, and ethical lapses.

The Portfolio Manager’s Line to Hold

Governance is where strategy meets accountability. A lapse in this area, whether it’s misleading performance reporting, a poorly disclosed conflict of interest, or unethical manager selection, can undo years of strong returns in an instant.

Strong portfolio managers proactively:

- Enforce documentation standards and audit trails.

- Report performance with honest attribution and benchmarking.

- Communicate risks clearly, even when inconvenient.

- Uphold the principles of stewardship, especially during difficult market cycles.

Ultimately, governance is what makes performance sustainable. Because in investment management, trust is capital, and the portfolio manager is responsible for preserving both.

Portfolio Manager Responsibilities

While portfolio managers wear many strategic hats, their effectiveness ultimately rests on execution. Below are the core responsibilities that define day-to-day portfolio management, where strategic intent meets disciplined action.

Constructing and Rebalancing Portfolio Allocations

One of the most hands-on responsibilities of a portfolio manager is the disciplined construction and rebalancing of investment allocations. While strategic asset allocation (SAA) sets the long-term target mix of equities, fixed income, and alternatives, ongoing portfolio drift can quietly undermine both risk control and performance.

Case Study

Market movements cause asset weights to shift, outperforming asset classes begin to dominate, while lagging ones shrink. Over time, this drift increases unintended risk concentrations, higher tracking error, and potentially greater volatility. A CIBC Asset Management study of a 60/40 equity–fixed income portfolio from 1981–2021 found that annual rebalancing reduced portfolio risk from 8.72% to 7.84% and cut the maximum drawdown from -30.65% to -24.42%.

What does it involve in practice?

- Portfolio construction: Building an allocation that aligns with the investment mandate, risk tolerance, liquidity needs, and regulatory constraints. This includes defining SAA ranges and tactical asset allocation (TAA) flexibility.

- Disciplined rebalancing: Periodically selling assets that have appreciated beyond their target range and reallocating to underweighted segments. This capitalizes on both momentum in the short term and mean reversion in the long term.

- Method selection: Using calendar-based (quarterly/annual) or threshold-based (e.g., ±5% drift from target) triggers to initiate rebalancing, balancing transaction costs with drift control.

- Execution discipline: Ensuring rebalancing is systematic, not ad hoc, to avoid unintended active bets that could conflict with the portfolio’s strategic intent.

| As Michael Sager of CIBC Asset Management notes:

“Disciplined portfolio rebalancing helps ensure risk and diversification remain within acceptable ranges, while avoiding the trap of confusing strategic allocation with market timing.” |

For institutional portfolio managers, this responsibility often extends to overlay strategies (e.g., futures or ETFs) to make allocation adjustments without disturbing core holdings, especially when managing large, illiquid positions.

Safeguarding Portfolio Liquidity and Cash Flow Resilience

Institutional portfolio managers must ensure that investment strategies can meet ongoing and unexpected cash flow needs without forcing asset sales at disadvantageous prices. Liquidity risk arises when investor capital is locked in for uncertain durations, creating potential funding shortfalls or triggering distressed sales, especially during volatile markets.

“Market participants willing to accept illiquidity achieve a significant edge in seeking high risk-adjusted returns. Because market players routinely overpay for liquidity, serious investors benefit by avoiding overpriced liquid securities and by embracing less liquid alternatives.”

|

Strategic Importance

During the 2008 financial crisis, many institutions faced “fire-sale” conditions, selling illiquid holdings at deep discounts to meet obligations. For endowments, pension funds, and sovereign funds, insufficient liquidity can directly threaten mission-critical payouts, such as scholarship distributions or retirement benefits. A structured liquidity budget is a safeguard against such disruptions.

Core Practices for Liquidity Oversight

- Portfolio segmentation: Classify assets into bands based on time-to-cash (e.g., <1 week, <1 quarter, <1 year, >1 year) and assign weight targets for each category. Example: 15% in highly liquid assets, max 40% in illiquid holdings.

- Detailed time-to-cash mapping: Evaluate each position’s liquidity profile under normal and stressed conditions, factoring in lock-ups, redemption gates, and account structures.

- Ongoing calibration: Use predefined tolerance bands or algorithm-driven adjustments to maintain optimal liquidity distribution and asset allocation.

- Crisis-readiness simulations: Conduct stress tests based on historical events, extreme statistical models, or forward-looking scenarios to evaluate liquidity adequacy under adverse conditions.

Evidence in Practice

A sample institutional portfolio assessed under the CFA Institute’s methodology showed 32.25% in highly liquid assets and 40% in illiquid assets. The weighted mix provided governance committees with a transparent liquidity map to validate alignment with policy limits and operational needs.

| As outlined in best-practice guidelines:

“A liquidity framework ensures that cash flow needs will be met without undue hardship, protecting both the portfolio’s value and its mission.” |

Performance Attribution and Reporting

A portfolio manager’s role goes beyond achieving returns; it’s about demonstrating how those returns were generated and whether they align with the mandate. Performance attribution and reporting form the backbone of this accountability.

| “For a portfolio manager, attribution is not just about proving value, it’s about earning the trust to manage tomorrow’s capital.” |

Key Responsibilities

- Conduct detailed attribution analysis to distinguish between returns driven by asset allocation, security selection, or market conditions, ensuring transparency in the investment process.

- Integrate asset-class–specific attribution models, such as the Brinson model for equities or the Campisi model for fixed income, to provide precise performance breakdowns.

- Leverage factor-based and quantitative models to capture deeper drivers of performance, including style factors, macro influences, and sentiment signals.

- Prepare clear, GIPS-aligned reports for boards, investment committees, and clients, translating complex attribution results into actionable insights.

- Monitor style drift by comparing actual positioning against the stated mandate, identifying unintentional shifts in strategy.

- Ensure benchmark accuracy to avoid misleading conclusions and adjust for variables like currency fluctuations and fees in global portfolios.

- Collaborate with risk and compliance teams to ensure that performance reporting meets both regulatory standards and stakeholder expectations.

Driving Cross-Functional Collaboration for Portfolio Success

A portfolio manager’s impact doesn’t end with project oversight; it depends on their ability to mobilize expertise across internal functions. From business analysts to finance teams, operations, IT, and strategy offices, effective collaboration ensures that portfolio decisions are grounded in accurate data, strategic alignment, and operational feasibility.

| “Siloed decision-making costs organizations up to 20–30% in lost efficiency.” |

Key Collaboration Touchpoints

- Business Analysts: Surface future opportunities, validate scope changes, and ensure that portfolio investments align with business needs and capabilities. Their early-stage insights often determine whether an initiative will achieve its intended outcomes.

- Finance Teams: Provide financial modeling, risk-adjusted return analysis, and capital allocation guardrails that influence go/no-go decisions at the portfolio level.

- Operations & Delivery Leaders: Offer visibility into resource capacity, operational bottlenecks, and change readiness, factors critical to prioritization.

- IT & Technology Teams: Enable feasibility assessments for digital or system-driven initiatives and advise on integration risks.

- Risk & Compliance Functions: Ensure investments adhere to regulatory frameworks and corporate governance standards.

Why is it required for the Portfolio Manager Role?

This level of collaboration turns the portfolio manager into a central integrator of intelligence, not just a resource gatekeeper. Finance provides early visibility into capital availability, risk teams flag regulatory exposures, and operations share delivery constraints, together creating a sharper, more grounded portfolio view.

Coordinated collaboration reduces duplicated work, speeds up decision cycles, and increases transparency. In high-change environments, this cross-functional fabric allows portfolio managers to adjust priorities quickly without losing strategic coherence. Over time, adjustments are no longer seen as setbacks but as agile recalibrations that keep the portfolio aligned with evolving business objectives.

Example in Practice

In 2024, a global healthcare company faced a mid-year funding shortfall in its innovation portfolio. The portfolio manager convened finance, operations, and R&D leads to re-score all initiatives using a joint value-risk framework. Within two weeks, they reallocated 18% of the budget to high-impact, compliance-critical projects, avoiding delays to a new medical device launch and improving overall portfolio ROI by an estimated 6% for the year.

Implementing Overlay and Derivative Strategies for Portfolio Coherence

In complex portfolio environments, different initiatives, programs, or business units can operate like separately managed accounts, each with its own priorities, timelines, and risk profiles. Without coordination, this can lead to duplication, conflicting actions, or missed strategic targets.

Overlay strategies address this challenge by creating a unified control layer above all these moving parts. “Overlay refers to a management style that harmonizes separately managed accounts,” ensuring that all components of the portfolio move in strategic alignment rather than at cross purposes.

The portfolio manager uses an overlay approach to align resource allocation, risk exposure, and execution cadence across the portfolio.

| “The overlay system analyzes any portfolio adjustments to ensure the overall portfolio remains in balance, preventing inefficiencies and coordinating efforts in line with…risk tolerance.” |

When paired with derivatives, such as futures, options, or swaps, overlay management enables precise adjustments without disrupting underlying initiatives. This can include:

- Rebalancing portfolio exposure to match strategic allocation targets across all programs.

- Mitigating risk by using derivative instruments to offset exposure in high-volatility areas.

- Optimizing tax and cost impacts by coordinating transactions across multiple workstreams.

- Streamlining execution by centralizing oversight while respecting the autonomy of individual program managers.

The result is a portfolio that responds to change without losing coherence, where every decision —from tactical shifts to major rebalancing moves, contributes directly to enterprise-wide strategic outcomes.

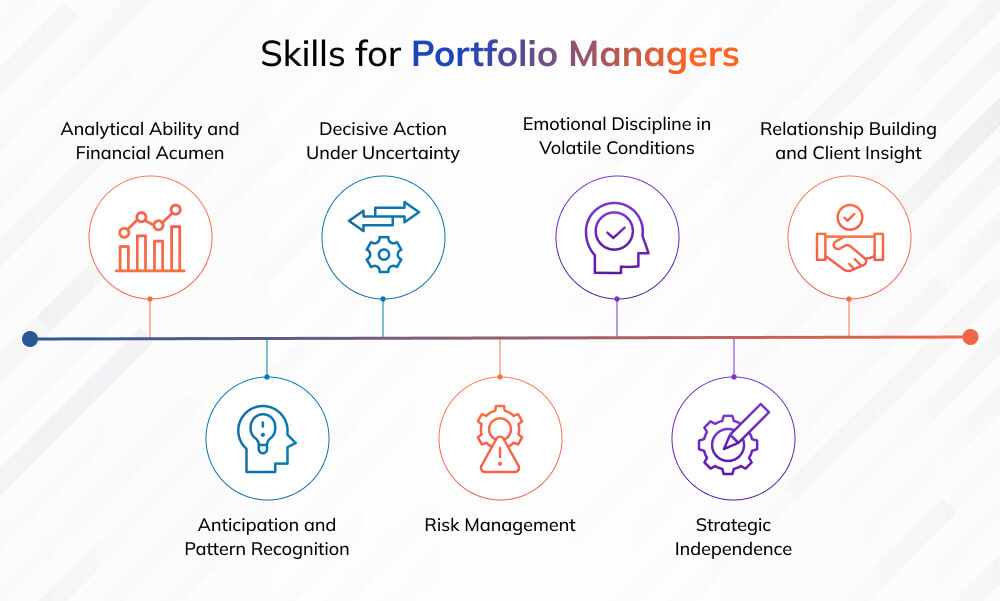

Essential Skills for Portfolio Managers

Being a portfolio manager is as much about judgment and foresight as it is about technical mastery. The role blends analytical rigor, strategic decision-making, and the ability to connect with clients, all under the pressure of volatile markets. Below are the skills that consistently separate high-performing portfolio managers from the rest.

Analytical Ability and Financial Acumen

Portfolio managers live in a world of data, earnings reports, macroeconomic indicators, sector trends, and company-specific signals. The ability to filter noise from substance is essential. This isn’t just about crunching numbers; it’s about scenario analysis, understanding correlations, and projecting outcomes under different market conditions.

For example, BlackRock’s global allocation team integrates economic models with geopolitical risk assessments to adjust positions ahead of anticipated shifts in interest rates or trade policy. That kind of analytical integration is what keeps performance ahead of benchmarks.

Anticipation and Pattern Recognition

Top portfolio managers don’t merely react to headlines; they connect early indicators to likely market outcomes. This involves scanning for patterns across regulatory changes, consumer behavior, and capital flows.

Temasek Holdings’ move into renewable energy infrastructure years before ESG surged into the mainstream is a case in point. Their ability to anticipate the shift positioned them as leaders in a high-growth sector.

Decisive Action Under Uncertainty

Markets move quickly, and over-analysis can cause missed opportunities. Once the data is assessed and risk is understood, portfolio managers must commit with conviction. In 2018, a Canadian pension fund shifted heavily into logistics real estate based on early e-commerce trends; this positioning paid off massively during the pandemic’s supply-chain boom.

Risk Management That Evolves with the Market

Static risk models don’t survive dynamic markets. Inflation spikes, technological disruption, and shifting regulations can all change the profile of a portfolio overnight. Adaptive risk management involves constantly re-evaluating exposures and rebalancing. In 2022, several U.S. university endowments increased allocations to inflation-protected securities and commodities ahead of prolonged price increases, avoiding the bond market’s steepest losses in decades.

Emotional Discipline in Volatile Conditions

Markets can test nerves. Sudden drops, euphoric rallies, or unexpected events can tempt reactionary decisions. Emotional discipline means sticking to strategy unless the fundamentals truly change. Norway’s Sovereign Wealth Fund, for instance, resisted panic selling during the COVID-19 crash, avoiding billions in realized losses and benefiting from the subsequent recovery.

Strategic Independence

Following the herd rarely produces outperformance. Exceptional portfolio managers develop independent viewpoints backed by thorough research, sometimes taking contrarian positions when the data support them. In the 2015 commodity slump, one hedge fund doubled exposure to select mining equities, a move that generated triple-digit returns during the recovery while competitors were still exiting.

Relationship Building and Client Insight

Technical skills may win trades, but relationships win long-term mandates. Portfolio managers who invest in understanding client priorities, beyond just risk tolerance questionnaires, can tailor strategies that align with deeper financial goals. This builds loyalty that withstands short-term dips in performance.

Portfolio Manager Salary Insights

Portfolio managers are among the highest-paid professionals in the financial services sector, reflecting the high stakes and strategic value of their role. Their compensation packages typically combine base salary, performance bonuses, and, in some cases, profit-sharing or equity incentives, directly linking earnings to the success of the portfolios they manage.

Average Salary Ranges by Level

| Role Level | Salary Range (USD) | Salary Range (GBP) | Career Impact |

| Entry Level / Associate PM | $70,000 – $95,000 | £50,000 – £65,000 | Builds core analytical and market skills under senior guidance |

| Mid-Level Portfolio Manager | $95,000 – $150,000 | £65,000 – £95,000 | Independently manages client portfolios and contributes to strategy |

| Senior / Lead PM | $150,000 – $250,000+ | £95,000 – £140,000+ | Shapes investment strategies, manages large AUM, and leads teams |

| Specialized PM (Quant, ESG, AI-driven, Alternatives) | $180,000 – $300,000+ | £110,000 – £160,000+ | Commands premium for niche expertise and technical skills |

Factors Influencing Portfolio Manager Compensation

- Assets Under Management (AUM): PMs overseeing large institutional portfolios often receive significantly higher bonuses tied to portfolio performance.

- Specialization Premiums: Professionals in quantitative investing, ESG strategies, or alternative asset classes can earn more than generalists due to demand for rare expertise.

- Geographic Market: Salaries in financial hubs like New York, London, Hong Kong, and Singapore are substantially higher, often paired with performance-linked perks.

- Firm Type: Compensation tends to be higher in hedge funds and asset management firms compared to retail banking or smaller investment advisories.

- Performance Metrics: Many firms operate on “eat what you kill” models, where bonuses directly correlate with alpha generation, risk-adjusted returns, and client retention.

Earning Potential Beyond Base Salary

Top-performing PMs in hedge funds or proprietary trading environments can earn seven-figure compensation when bonuses, carried interest, or equity stakes are factored in. This makes portfolio management one of the most financially rewarding career paths in finance, but also one of the most competitive and performance-driven.

Career in Portfolio Management

A career in portfolio management offers a unique blend of analytical challenge, strategic decision-making, and high financial reward. Portfolio managers are entrusted with managing investments that can span millions, or even billions of dollars, making it one of the most prestigious and influential roles in the financial services industry.

Role Overview

Portfolio managers are responsible for developing, implementing, and overseeing investment strategies for individual clients, institutions, or funds. They make allocation decisions across asset classes, monitor portfolio performance, rebalance holdings, and ensure alignment with client objectives, risk tolerance, and market conditions. This requires a balance of technical expertise, market intuition, and strong relationship management skills.

Typical Career Path

- Entry-Level (Analyst / Associate): Most professionals start as research analysts or associate portfolio managers, supporting senior PMs through data analysis, financial modeling, and market research.

- Mid-Level (Portfolio Manager): Progression to independently managing smaller client accounts or a segment of a larger portfolio, with increasing responsibility for investment decisions.

- Senior-Level (Lead PM / CIO Track): Leading major portfolios, setting firm-wide investment strategies, and potentially moving into executive leadership roles like Chief Investment Officer.

Growth Outlook

According to the U.S. Bureau of Labor Statistics, demand for portfolio managers and related investment professionals is projected to grow 17% over the next decade, outpacing the average for most occupations. This growth is driven by expanding global capital markets, increased interest in ESG and thematic investing, and the need for sophisticated risk management.

“Portfolio management remains one of the few finance careers where performance directly drives career progression, and earnings potential can scale exponentially with AUM growth.”

Diverse Opportunities

Portfolio managers can work across a wide spectrum of environments:

- Asset Management Firms & Mutual Funds: Managing diversified retail and institutional portfolios.

- Hedge Funds: Specializing in high-return, high-risk strategies.

- Private Wealth Management: Catering to high-net-worth individuals and family offices.

- Pension Funds & Endowments: Balancing growth and stability for long-term mandates.

- Sovereign Wealth Funds: Deploying national capital in global markets.

Specialization Pathways

As the field evolves, niche expertise is increasingly valuable. PMs may specialize in areas like:

- Quantitative & Algorithmic Strategies: Leveraging AI and big data for predictive modeling.

- ESG & Sustainable Investing: Integrating environmental, social, and governance factors.

- Alternative Assets: Including private equity, venture capital, and real estate portfolios.

Key Career Advantages

- Performance-Linked Rewards: High earnings potential, often tied to portfolio success.

- Global Mobility: Skills are transferable across markets and geographies.

- Strategic Influence: Opportunity to shape investment outcomes for organizations and individuals.

- Continuous Learning: Exposure to evolving markets, asset classes, and investment technologies.

Portfolio management is a career for professionals who thrive under pressure, enjoy solving complex financial puzzles, and can blend hard data with market foresight. It offers not just lucrative rewards, but also a front-row seat to the forces shaping the global economy.

Conclusion

Portfolio management is more than just picking investments; it’s about strategically navigating markets, managing risk, and building wealth with precision and purpose. Whether you’re optimizing returns for institutional investors or crafting a growth plan for high-net-worth clients, the role demands a unique mix of analytical rigor, decision-making confidence, and relationship-building skill.

As global financial markets become more complex and interconnected, the demand for skilled portfolio managers continues to grow. Those who can master both technical expertise and strategic vision will be well-positioned to lead in this high-impact field.

If you’re ready to take the next step in your portfolio management career or break into the field with a globally recognized credential, Invensis Learning can help you get there. We offer certification training that equips you with industry best practices, practical tools, and exam-ready preparation to accelerate your career growth. You’re not just earning a credential, you’re building the skills to lead in one of finance’s most rewarding roles.

Take the next step with Invensis Learning and invest in your future.