A risk compliance manager job description ensures that the organization conducts its business processes in compliance with laws and regulations, professional standards, international standards, and accepted business practices. These professionals perform audits at regular intervals and execute design control systems, advising the management on possible risks that might occur, and organization policies.

The major task of a compliance manager is to uphold the ethical integrity of the organization and also ensure that business activities are conducted using a regulatory framework. These professionals carry out the risk management process by thorough planning of business and implementing the policies within the organization.

Starting your career as a Risk Compliance Manager is not at all a relaxed task, instead, it requires detailed expertise and attention to minute details. If you are planning to pursue this career path, it’s essential to understand what this job role entails and how it is beneficial to your career.

Responsibilities of a Risk Compliance Manager

Risk compliance managers are considered to be a vital component of corporate governance. They are also responsible to determine how an organization could be handled and governed. Risk and compliance officer job description includes maintaining good rapport between the stakeholders and adhering to the objectives set by the organization.

The roles and responsibilities of a compliance manager vary depending upon the industry, but typical responsibilities are compiled below:

- They are accountable for ensuring all the essential guidelines are put in proper place accurately adhering to industry rules and regulations

- They conduct internal audits and reviews at regular intervals to ensure that compliance procedures are regularly followed

- They conduct environmental audits adhering to environmental standards

- The compliance risk manager role involves the safety of employees and businesses as well. So it’s their part of the duty to ensure all the tasks are done with higher accuracy. This job role is apt for the individual who gives attention to all the minute details within the organization

- They have to ensure that all the employees are thoroughly updated about the organization’s policies, regulations, and processes

- Resolve employee issues about the legal risk compliances

- They should suggest/advise the management regarding the implementation of compliance programs

- They must adhere to the training and supervise the staff that needs attention to rules and regulations

- Revise rules, reports, and procedures at regular intervals to recognize the risks

Quintessential Skills of a Compliance Manager

“The role of the compliance officer is changing and finding staff with suitable skills is indeed a higher priority than ever before. A critical component to managing all the complex regulatory changes will be finding component compliance staff and giving them the tools and resources to enhance their skills and influence”.

– Klewin

Directory of Regulatory Compliance

To execute the above tasks, the compliance manager should possess a set of skills and expertise in the domain. Here is a compiled skill set for risk compliance managers:

Communication Skills

Irrespective of domain and job role having excellent written and verbal communication skills are indeed very much essential. Similarly, the risk compliance manager should be capable to communicate with level employees.

Risk Assessment Capabilities

The major steps involved in risk management are identification, analysis, planning, monitoring, reporting, and controlling risks. Hence, the risk compliance manager should thoroughly these steps and should be able to implement them t accordingly. In order to assess risks and interpret them properly, having fundamental knowledge about rules and regulations must be defined clearly.

Attention to Detail

Most of the rules, regulations, and policies within the organization need detailed analysis. It’s essential to pay attention to all the minute details.

Thorough Knowledge about Vulnerability/Security

A compliance manager should have comprehensive knowledge about security policies such as ISO standards, control, and abuse policies, regulations, monitoring, evaluation, review, and report associated with auditing.

Business Knowledge

Having an in-depth knowledge of business and IT will definitely ensure a smooth audit session. Essential IT tools and risk-compliance-related technology should be always mastered by the compliance manager.

Problem-Solving Skills

There are chances of risk compliance officers coming up with imprecise regulatory policies and business issues. Thus, having problem-solving capability requires implementation and monitoring of the solution. The process should be carried out in considering pre-defined steps and appropriate feedback should be given to the chosen solution.

Organizational Skills

The risk compliance manager should possess multi-tasking skills. They should be clear about what has to be done and how the process has to be carried out.

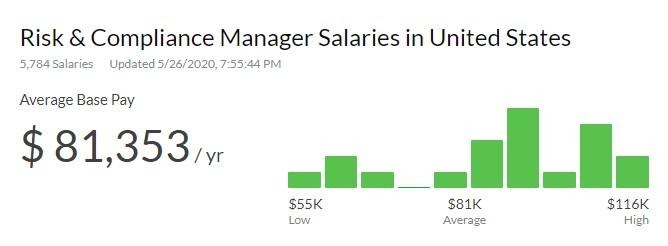

Salary Insights

United States

The average salary of a Risk Compliance Manager in the United States is $81,353 and the range falls between $55,000 and $116,000. The salary range varies considering various factors such as years of experience, education, and certifications gained in the field.

Conclusion

A Risk Compliance manager will help the organizations conform to guidelines and associated rules and regulations. They are accountable for auditing, overseeing and ensuring that the process within the organization doesn’t violate regulations. Their task is an ongoing initiative that continually responds to business growth, newly implemented laws, and changing regulatory environment.

Aspiring and experienced Risk Compliance Managers need to reskill and upskill in IT Governance Certification courses to stay relevant and to learn new best practices and industry-recognized frameworks to achieve growth in their career.

Some of the popular courses that Risk Compliance Managers and other Risk Management professionals can take up are: